Acknowledgment of an improper tax credit received by the Democratic Senate nominee in Maryland is giving her Republican opponent some political ammunition – in a race that’s one of a handful which may decide if the GOP wins back the chamber’s majority.

Angela Alsobrooks’ campaign says the chief executive of Prince George’s County – Maryland’s second-largest county – will pay back taxes after improperly taking advantage of property tax breaks.

The tax credits – which Alsobrooks did not qualify for – included one meant for low-income senior citizens and a homestead tax break, which is restricted to homes listed as an owner’s primary residence.

BLUE-STATE REPUBLICAN TOUTS HIS ANTI-TRUMP CREDENTIALS

Alsobrooks’ campaign says she was not aware of the tax errors, which were first reported by CNN. The campaign adds that the tax error resulted in Alsobrooks paying more in property taxes.

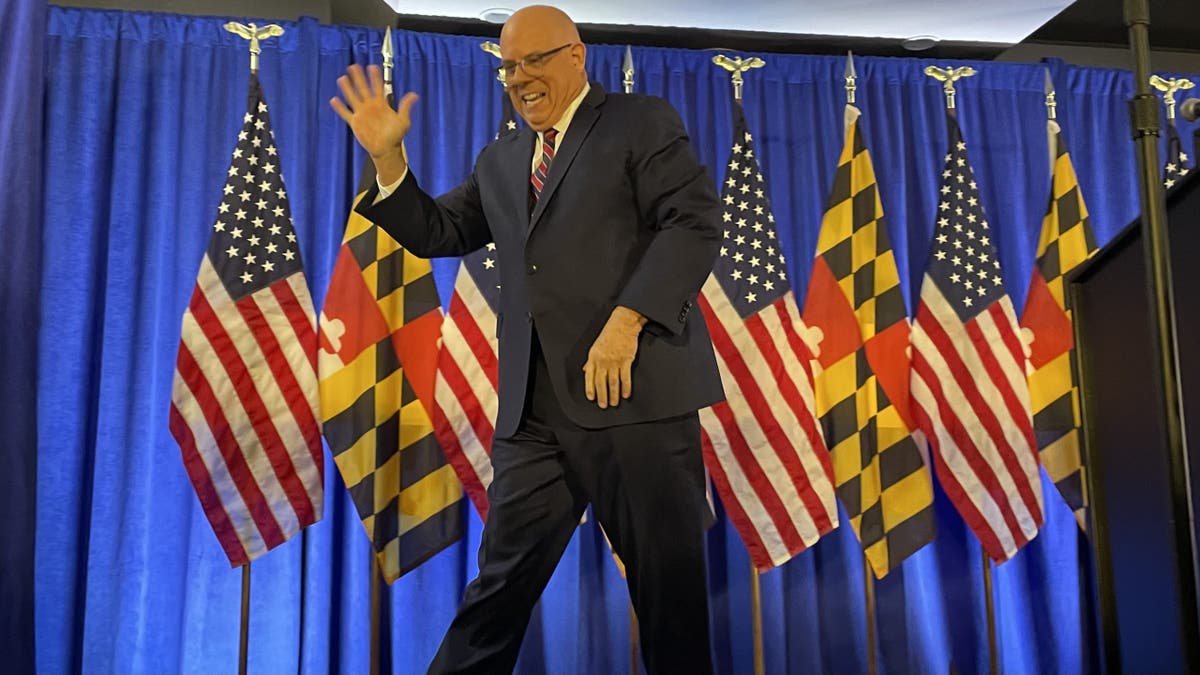

Alsobrooks is facing off with former two-term Republican Gov. Larry Hogan of Maryland in a very competitive race to succeed Democratic Sen. Ben Cardin, who is retiring this year after serving nearly two decades in the Senate and nearly six decades as a state and then federal lawmaker. Hogan is aiming to flip a long-held Democratic seat in an overwhelmingly blue state.

SENATE DEMOCRATS CAMPAIGN CHAIR GOES ONE-ON-ONE WITH FOX NEWS

“It’s deeply disturbing that Angela Alsobrooks thinks the rules don’t apply to her. She campaigns on raising taxes while failing to pay her own and taking advantage of tax credits reserved for the poor and elderly. She claims to be unaware of tax laws it was her job to enforce,” Hogan campaign spokesperson Blake Kernen argued.

Kernen added, “Hogan has always stood up for taxpayers and in the Senate he will continue to fight for fairness and fiscal responsibility.”

Alsobrooks’ campaign noted Hogan – in 2016 – also received a tax break on his Maryland home while he was living in the governor’s mansion in Annapolis. But governors are exempt from residency requirements.

Democrats control the Senate by a razor-thin 51-49 margin, and Republicans are looking at a favorable election map this year with Democrats defending 23 of the 34 seats up for grabs.

One of those seats is in West Virginia, a deep red state that Trump carried by nearly 40 points in 2020. With moderate Democrat-turned-Independent Sen. Joe Manchin, a former governor, not seeking re-election, flipping the seat is nearly a sure thing for the GOP.

Republicans are also aiming to flip seats in Ohio and Montana, two states Trump comfortably carried four years ago. And five more Democratic-held seats up for grabs this year are in crucial presidential-election battleground states.

With Democrats trying to protect their fragile Senate majority, Hogan’s late entry into the race in February gave them an unexpected headache in a state previously considered safe territory. Hogan left the governor’s office at the beginning of 2023 with very positive approval and favorable ratings.

Get the latest updates from the 2024 campaign trail, exclusive interviews and more at our Fox News Digital election hub.

Read the full article here